IETA publishes false claims about REDD+ sovereign carbon, as voluntary carbon market stagnates in Q1

New York, Tuesday, April 25, 2023: As the voluntary carbon market stagnates and the arrival of REDD+ sovereign carbon looms, the International Emissions Trading Association (IETA) has published a white paper that tries to discredit the use of REDD+ sovereign carbon credits verified under the Paris Agreement for corporate climate claims.

After a disastrous first quarter for the voluntary carbon markets (VCM) with forestry project scandals hitting the headlines and VERRA scrambling to introduce new carbon avoidance methodology in response, the market is stagnating. The world’s largest spot carbon exchange, Xpansiv reported that it had only traded 9 million tons of carbon versus 47 million tons during the first quarter of 2022.

“VCM is struggling, and desperation is now setting in for those holding VCM credits”, says Kevin Conrad, Executive Director, Coalition for Rainforest Nations (CfRN). “It comes as no surprise that some of those holding VCM credits within IETA’s membership are coming out with feeble attacks on UNFCCC REDD+ and the sovereign rights of our countries to sell Paris Agreement compliant carbon reductions.”

IETA’s latest white paper, “Valuing REDD+ Activities: Key Differences Between Market-Based Credits & Results-Based Payments”, found on the IETA website, claims that the results under the UNFCCC REDD+ framework should not be marketed as carbon credits and that sovereign REDD+ carbon credits, called REDD+ Results Units (RRUs) are not verified carbon credits. IETA’s current position is that results reported on the UNFCCC REDD+ Info Hub, including RRUs, are not market grade, and should not be treated as fungible carbon credits in the market.

However, Sovereign REDD+ carbon credits, authorized under Article 5.2 of the Paris Agreement, can be used as carbon offsets by non-governmental entities. Two legal opinions written by two leading law affirms this, independently finding that, in summary:

- There are no legal reasons, under the UN Treaties, that REDD+ units in the form of REDD+ Results Units (RRUs) cannot be issued, held, or retired as carbon credits, just like other units generated under UNFCCC mechanisms, such as Certified Emissions Reductions (CER)s and Emission Reduction Units (ERUs).

- UNFCCC REDD+ Results, authorized under Article 5.2, can be converted into either a REDD+ Results Unit (RRU) or an Internationally Transferrable Mitigation Outcome (ITMO) type of RRU, and be later used as a carbon offset by non-governmental entities.

REDD+ Results Units are carbon credits. Thus, REDD+ Results Units can be traded within global carbon markets. In fact, this has always been considered one way to support REDD+ activities under results-based financing.

“Looking ahead, RRUs will be submitted under Article 6.2 beginning this year. Nothing prohibits a Host Party to authorize RRUs as ITMOs under Article 6.2 of the Paris Agreement. There is no restriction under UNFCCC decisions limiting transfer of RRUs to private entities in addition to a country. Claims otherwise are misleading and incorrect,” says Federica Bietta, Managing Director, CfRN.

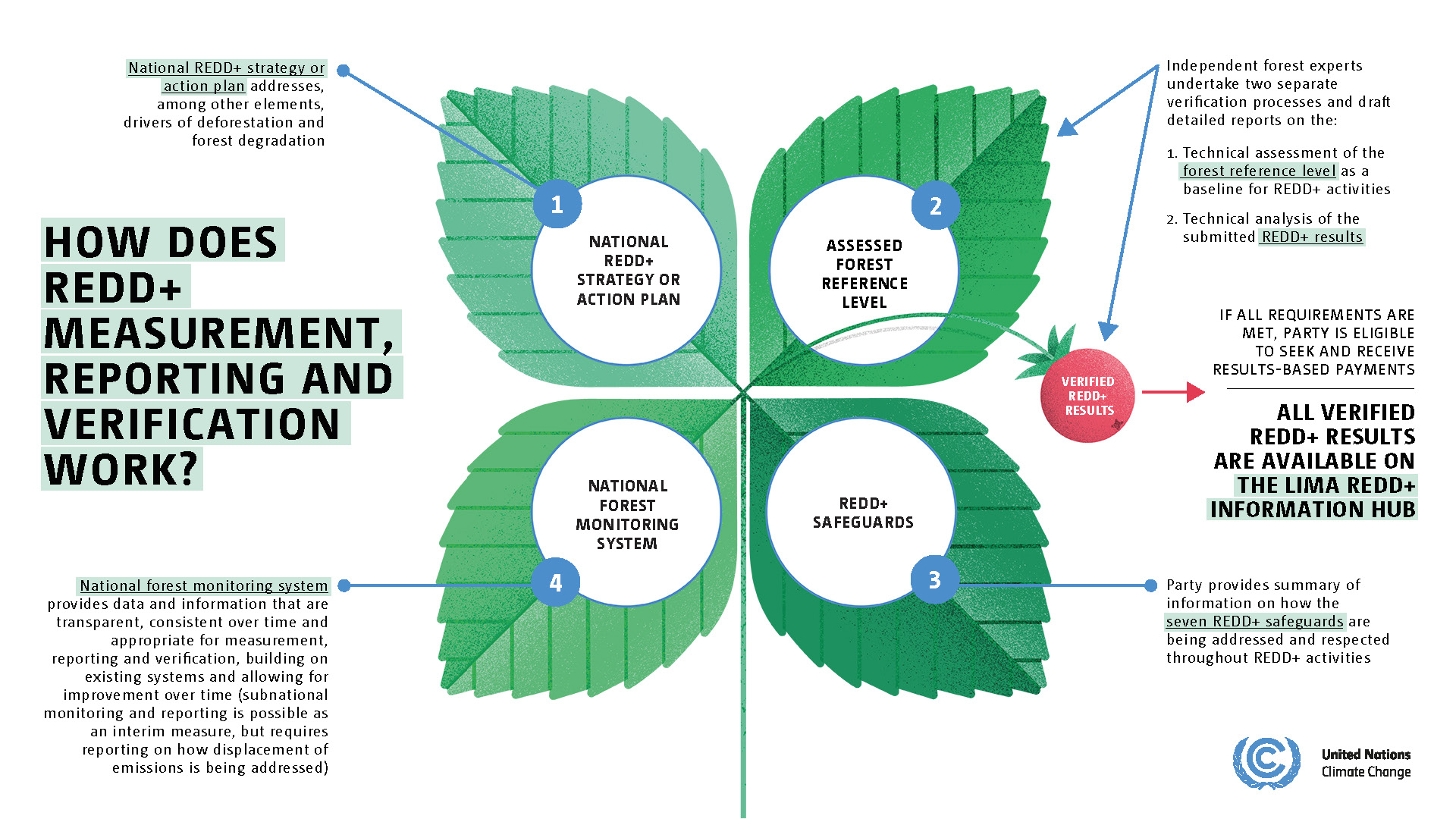

The system to measure and report REDD+ results was agreed by the consensus of nearly 200 nations over 10 years. And it was later reaffirmed under Article 5 of the Paris Agreement.

RRUs are indeed verified or assessed under the UNFCCC’s REDD+ Measuring, Reporting and Verification process. The UNFCCC requires national scale accounting in order to address leakage and reporting in consecutive Global Stock-takes to address permanence. Further, RRUs are subject to safeguards, noting that the UN specifically requires related reporting.

More recently, at COP27, the Sharm El Sheikh Implementation Plan reaffirmed previous COP decisions for developing nations to finance forest preservation through both public fund payments and private purchases of REDD+ emission reductions. Many developing countries have acted in good faith to protect or enhance their vitally important forests in accordance with a UN international agreement and need to be compensated for those actions in order to continue with their stewardship activities. REDD+ sovereign carbon will help them achieve these objectives.

IETA’s position echoes previous statements from organizations, like Trove Research, who also misleadingly claim that UNFCCC REDD+ credits are “not rigorous enough to offset or compensate for emissions.”

In fact, all UNFCCC-verified RRUs offered on the REDD.plus platform are already fit for purpose. UNFCCC REDD+ Results are the most robust method for crediting the actions taken to conserve the world’s forests. They are also included in countries’ respective Nationally Determined Contributions (NDCs) and further authorized and issued by sovereign rainforest nations.

“The UNFCCC REDD+ framework is more suitable to offsetting claims than what is currently being used by many corporate buyers. These carbon credits are better than anything coming out of the voluntary market,” says Emilio Sempris, former Environment Minister of Panama. “They’re national in scale, so there’s no leakage; the permanence issue is picked up because you have to report every five years; and the reference level is based on hard factual evidence of what your emissions were in the past. They are authorized and issued by the relevant sovereign. None of these principles are in the voluntary carbon market, none.”

For more information, contact: info@rainforestcoalition.org