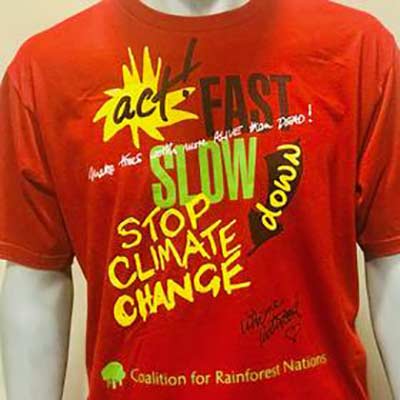

Help Save Rainforests & Endangered Species

Your donation to CfRN protects our rainforests

Your donation to CfRN protects our rainforests

Thank you for supporting the Coalition for Rainforest Nations, a tax-deductible, 501c3 non-profit organization (US tax-ID number: 26-3221530)

CfRN Online Donation Form

Donation Options

Complete our online donation form to make a one-time or recurring gift. Or select another way to donate below:

Paypal

Clicking on “Donate” button you can donate with PayPal or major credit and debit cards.

Check

To Donate by Check (make check payable to Coalition for Rainforest Nations). Please mail to:

Coalition for Rainforest Nations, 52 Vanderbilt Avenue, 15th Floor, Suite 1510, New York, NY 10017, USA

In our effort to save rainforests and cut down on our carbon footprint, we would like to ask you to include an email address along with your check donation for a tax receipt.

Wire and Direct Deposit

You will need direct deposit information to make a wire transfer to CfRN. Please click below to access this information.

International Donations

Making Tax deductable donations is easy with the following links .

Netherlands

Coalition for Rainforest Nations is registered in the Netherlands as a PBO-organization (RSIN: 8261.87.316)

If you would like to set up recurring donations, please complete the form Dutch Periodic Gift Agreement.

Canada

If you are resident of Canada, you can also donate through CfRN’s dedicated page on rcforward.org. Tax deduction documentation is available.

Donors can use the drop-down menu and scroll to find the name “Coalition for Rainforest Nations” to donate.

If you prefer to give via Wire Transfer, Stocks, or Cheques! Please use the attached “CAFC How to Give” form for directions.

To accompany donations not made online.